Content

We need to work out the balance on each of these accounts in order to compile the trial balance. A bank may have substantial sums in off-balance-sheet accounts, and the distinction between these accounts may not seem obvious. For example, when a bank has a customer who deposits $1 million in a regular bank deposit account, the bank has a $1 million liability. If the customer chooses to transfer the deposit to a money market mutual fund account sponsored by the same bank, the $1 million would not be a liability of the bank, but an amount held in trust for the client . If the funds are used to purchase stock, the stock is similarly not owned by the bank, and do not appear as an asset or liability of the bank.

- Under current accounting rules , operating leases are on the balance sheet.

- When a balance is written off, the system will generate a Receivable credit or Receivable invoice that is then displayed in the Transactions tab for the Receivable account.

- Use this in conjunction with Expired to see the full balance expiry at the end of the plan period.

- Touch device users, explore by touch or with swipe gestures.

- Use this feature to write off an uneconomic balance for a single Receivable account.

- We also reference original research from other reputable publishers where appropriate.

If the client subsequently sells the stock and deposits the proceeds in a regular bank account, these would now again appear as a liability of the bank. Balance sheet accounts have balancing figures, but revenue and expenses account do not. This is because the figures for revenue, expenses and drawing, when they are aggregated and offset in the income statement, to adjust the capital accounts. As such, the balances of those accounts appear in the capital account in the following period and do not just disappear in the next accounting period. We will now continue from where we left off intopic 2.2.In order for us to generate a trial balance we first need to balance off the ledger accounts. Balancing the accounts simply means that both the debit and credit side of each account should be equal.

Ready To Connect With Business Leaders?

Companies must followSecurities and Exchange Commission andgenerally accepted accounting principles requirements by disclosing OBSF in the notes of its financial statements. Investors can study these notes and use them to decipher the depth of potential financial issues, although as the Enron case showed, this is not always as straightforward as it seems. The practice of off-balance sheet financing has come under increasing scrutiny after a number of accounting scandals revealed the mis-use of the practice. While not recorded on the balance sheet itself, these items are nevertheless assets and liabilities of the company. Off-balance sheet items are an accounting practice whereby a company does not include a liability on its balance sheet. Off balance sheet , or incognito leverage, usually means an asset or debt or financing activity not on the company’s balance sheet.

Additionally, OBSF for sale andleasebacktransactions will not be available. Like an operating lease, the company only lists the rental expenses on its balance sheet, while the asset itself is listed on the balance sheet of the owning business. Generally, an improperly balanced tire is the first place any reputable mechanic or technician will tell you to start looking when trying to resolve the issues stated above. Thankfully for you, our technicians here at ORW are here to keep the process smooth and steady with our road force tire balancing services. You balance your account by introducing your balancing figure on the side the smallest amount. This figure should be your balance carried down at the end of the period and would be brought down at the start of the next period.

Off-Balance Sheet (OBS) Activities: Types and Examples

For the side that does not add up to this total, calculate the figure that makes it add up by deducting the smaller from the larger amount. Enter this figure so that the total adds up, and call it the balance carried down. Minimum Increment – The minimum increment of time-off required for the time-off type. If all of the steps are done correctly, the errors will be found, and the ledger will be balanced. Under aleaseback agreement, a company can sell an asset, such as a piece of property, to another entity. They may then lease that same property back from the new owner.

- You must add up all of the debit balances, and all of the credit balances to see if the two totals are the same.

- We’ve pioneered distance learning for over 50 years, bringing university to you wherever you are so you can fit study around your life.

- Other types of accounts use a balance brought down in order to determine the opening balance of the account in the subsequent trading period.

- Carried Over – If an employee is entitled to carry over unused time from the previous year, it appears in this column.

- Time-Off Type – The employee’s name and the time-off types that are available to them.

- The balancing figure appears before the total boxes while the brought down figure appear under the total boxes on the opposite side to that of the balancing figure.

If the trial balance is out of balance, at least one error has been made. Since 2020, our world has been changed by the COVID-19 pandemic. So in this CityLead session, we’re talking about how to handle the disruptors caused by the pandemic, in both life and in business.

off balance | American Dictionary

Counteract Balancing Beads are the economical way to balance the vehicle wheel assembly for the lifetime of the tire. Made of coated glass spheres, Counteract Balancing Beads will not cause damage to the inner liner of the tire, they won’t clump, regardless of excess moisture and are TPMS compatible. A bargain purchase option in a lease agreement allows the lessee to purchase the leased asset at the end of the lease period at a lower price. A capital lease is a contract entitling a renter the temporary use of an asset and, in accounting terms, has asset ownership characteristics.

- Risk insurance also becomes helpful when you need credit protection.

- Thankfully for you, our technicians here at ORW are here to keep the process smooth and steady with our road force tire balancing services.

- Making the decision to study can be a big step, which is why you’ll want a trusted University.

- This is based on the rules defined in the plan assigned to them.

- Minimum Increment – The minimum increment of time-off required for the time-off type.

- A trial balance is a listing of the account balances in a ledger.

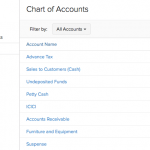

Calculate the total of both side of the account (one side in the case of revenue and expense accounts. The computer and bank loan accounts have single entries on one side, like the furniture account, so they need to be treated in the same way. This amount is the total as well as the balance in the account.

Bank Account

A transaction will be created for each Receivable account that has had a small balance written off. This process may be run for a single Receivable account from two possible screens, allowing you to do this easily as part of your workflow, or globally for all Receivable accounts that fit the parameter selected. Increment Unit – Indicates balancing off whether the minimum increment of time-off is in days or hours. For example, approved time-off request, manual adjustment, or automatic accrual. Add this if you are looking to display each time off change individually. Carried Over – If an employee is entitled to carry over unused time from the previous year, it appears in this column.

What is balance off?

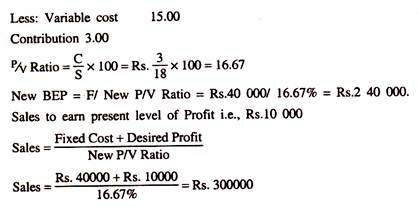

Quick Reference. The practice of totalling the debit and credit sides of an account and inserting a balance to make them equal at the end of a financial accounting period.